Mortgage statement information

Mortgage statement guide

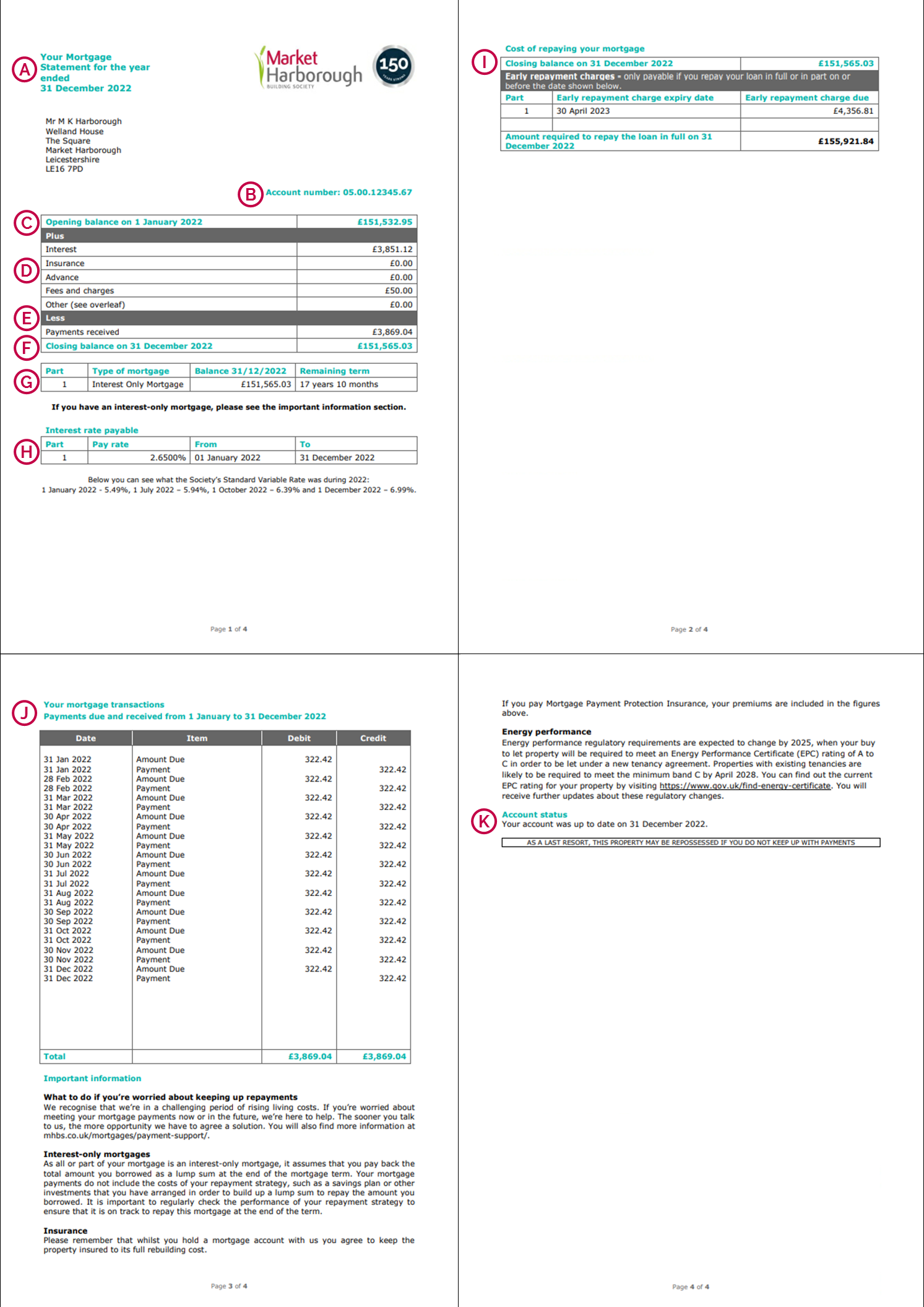

A – Statement date

The period that is covered in this statement.

B – Account number

If you need to contact us about your mortgage, please quote this number.

C – Opening balance

This was the balance on your mortgage as at 1 January 2022. If your mortgage was taken out after 1 January, the balance will be shown as £0.00.

D – Plus

This is a list of items charged to your mortgage between 1 January 2022 – 31 December 2022.

Interest – the amount of interest charged between 1 January 2022 and 31 December 2022. Interest is calculated on a daily basis but is charged to your mortgage monthly.

Insurance – this is the annual cost of any insurance you hold with us such as buildings insurance, buildings and contents insurance or Mortgage Payment Protection Insurance. Interest is not charged on insurance accounts.

Advance – any additional borrowing taken in the year.

Fees and charges – this is the total of all fees and charges applied to your account during the year. Please see section J for a breakdown.

Other (see overleaf) – refer to the debit column in section J.

E – Less

This is the total of payments received between 1 January 2022 – 31 December 2022. Please see section J for a breakdown.

F – Closing balance

This was the balance of your mortgage as at 31 December 2022.

G – Summary

Type of Mortgage – this confirms whether your mortgage is on an Interest Only basis or a Capital and Interest repayment basis. If you hold an Interest Only loan, your monthly payments will only cover the interest and will not repay any of the amount you have borrowed which you will have to repay at the end of the mortgage term. We strongly recommend that you refer to our website for further ‘Important Information’ on Interest Only mortgages if you have a loan of this type. If you hold a capital and interest repayment basis mortgage your monthly payments will gradually repay both the amount you have borrowed and the interest on your loan over your mortgage term.

Balance – this was the closing balance of your mortgage as at 31 December 2022.

Remaining term – the remaining term for each part of your loan in years and months as at 31 December 2022.

H – Interest rate payable

These are the interest rates charged during the year for each part of your loan. The interest rates may be different for each part of your loan depending on which product you chose when your loan was taken out.

I – Cost to repay your mortgage

Early repayment charge – this will be applied if you repay your loan in full or in part within an early repayment charge period. Details of early repayment charges are shown in your mortgage offer.

Mortgage Exit Fee – is charged for work involved when you repay your mortgage.

There may be other fees payable when you redeem your mortgage. Please refer to the Market Harborough Building Society Tariff of Mortgage Charges for more information.

J – Payments due and payments received

The payments due (debit column) shows the payments which are due each month. If you pay your household insurance premium monthly the amount payable for this will also be included in the payment due.

The payments received (credit column) shows any monthly payments, you have paid between 1 January and 31 December 2022. It assumes that any payments made by cheque or direct debit in the last few days of December 2022 will be honoured.

K – Account status

This will either confirm that your account was up to date on 31 December 2022 or that there was a payment shortfall. If you are behind in your mortgage payments, please contact us as soon as possible in order that we can discuss this with you.